Johannesburg – JSE-listed Aspen Pharmacare Holdings Limited (APN), a global multinational specialty pharmaceutical company, has released reviewed condensed Group financial results for the year ended 30 June 2025.

Stephen Saad, Aspen Group Chief Executive said, “The strong momentum in Commercial Pharmaceuticals has been sustained, and this business is well positioned for future growth. This is underpinned by a solid foundation of organic growth and the realisation of returns on the Group’s extensive investment in its generic semaglutide GLP-1 strategy. It has been a challenging year for Manufacturing with performance being significantly impacted by the loss of a material contract. Consequently, we have had to modify our strategy with a plan to recover lost profitability within our Finished Dose Form business by FY 2027. Improved free cash flow generation is a key objective for the year ahead supported by reduced capital expenditure and working capital investment.”

NOTABLE EVENTS OVER THE REPORTING PERIOD (“FY 2025”)

- Commercial Pharmaceuticals, Aspen’s core business segment comprising more than 70% of the Group’s revenue, has delivered revenue and normalised EBITDA growth of 10% in constant exchange rate (“CER”) underpinned by organic revenue growth in all three segments (Injectables, Over the counter (“OTC”) and Prescription). This has been supplemented by the launch and rollout of Mounjaro® in South Africa, while also benefiting from the acquired product portfolio in Latin America. Reported performance has been diluted by the strength of the ZAR average exchange rates against Aspen’s major trading currencies;

- Considerable progress has been made in executing the Group’s generic semaglutide GLP-1 strategy;

- The restructure of Aspen China and its integration with the acquired Sandoz business has been completed. Consequently, significant restructuring costs of circa R0,5 billion were incurred in H2 2025 as well as one-off inventory rationalisation and write-offs of R0,3 billion. These diluted the Group’s Injectables gross profit margin percentage in FY 2025. This is expected to revert to normal levels in FY 2026. The restructured China business, supported by higher EBITDA margins, is now well positioned to contribute positively towards earnings growth in FY 2026;

- Manufacturing performance and intangible asset impairments have been negatively impacted by the material contractual dispute (“Dispute”) announced on SENS on 22 April 2025, whereby shareholders were advised that normalised EBITDA from the Manufacturing business for FY 2025 in CER would potentially be R2 billion lower than last guided in March 2025. The Dispute, the details of which are subject to contractual confidentiality, relates to a manufacturing and technology agreement with a contract manufacturing customer for mRNA products. As a consequence of the Dispute and related risks, normalised EBITDA from the Manufacturing business for FY 2025 of R0,7 billion in CER was 38% of that reported in FY 2024. The Dispute is now the subject of a contractually prescribed adjudication process;

- Aspen is pleased to report that the validation stage of the insulin contract has been successfully completed in our South African sterile facility. In anticipation of regulatory approvals being received shortly, commercial production has already been initiated;

- The retrospective implementation of global minimum tax legislation in South Africa coupled with the announcement by the Mauritian government of a Qualified Domestic Minimum Top Up Tax (“QDMTT”) of 15%, effective from FY 2025, has negatively impacted both Commercial Pharmaceuticals intangible asset valuations and Group effective tax rates. As guided previously, higher Group effective tax rates are expected to be sustained. The QDMTT has materially increased the tax rate used for Commercial Pharmaceuticals brand related intangible asset valuations increasing impairments by R1,7 billion. These intangible assets are only impaired if the individual brand asset value is below carrying amount and are not revalued above cost where their individual brand value exceeds carrying amount. Despite the negative impact of the QDMTT, total brand related intangible assets still have a valuation of more than 50% greater than their carrying amount;

- The abovementioned intangible asset impairments totalling R4,1 billion, which comprises the QDMTT related impact of R1,7 billion, the mRNA asset impairment of R0,8 billion and regional performance related impairments of R1,6 billion, have resulted in the Group incurring a loss for the year. These impairments and the increased restructuring costs have adversely impacted Aspen’s earnings per share (“EPS”) and headline earnings per share (“HEPS”) as compared to the Group’s primary measure of performance being normalised headline earnings per share (“NHEPS”);

- Operating cash conversion rate of 147% well exceeded the Group’s target of 100%. The leverage ratio ended at 3.2x. Net debt of R31,2 billion was marginally higher than the R30,0 billion in H1 2025, negatively affected by the weaker ZAR year-end closing rates partly offset by the stronger second half CER operating cash flows and lower inventory levels; and

- Finance costs benefited from interest rate cuts across the Group’s EUR, ZAR and AUD debt pools in the second half of the year. Despite this, year-on-year finance costs have risen, influenced by higher net debt levels and increased foreign exchange losses driven by US tariff-led global volatility in exchange rates.

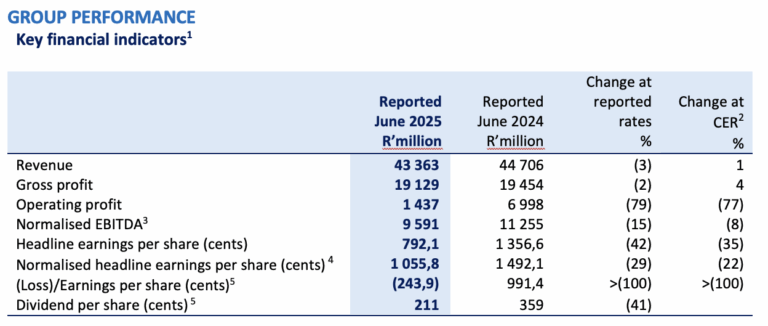

1 The Group assesses its operational performance using constant exchange rates (“CER”). The table above compares performance to the prior comparable period at reported exchange rates and at CER.

2 The CER percentage change is based upon the performance for the six months ended 30 June 2024 recalculated using the average exchange rates for the year ended 30 June 2025.

3 Operating profit before depreciation and amortisation adjusted for specific non-trading items as defined in the Group’s accounting policy.

4 Normalised headline earnings per share (“NHEPS”) is headline earnings per share (“HEPS”) adjusted for specific non-trading items as defined in the Group’s accounting policy.

5 Dividend declared on 3 September 2025, to be paid on 6 October 2025 (2024: Declared on 3 September 2024 and paid on 23 September 2024).

SEGMENTAL PERFORMANCE

Commercial Pharmaceuticals

Commercial Pharmaceuticals delivered solid revenue growth of 5% (10% CER) to R32 216 million and normalised EBITDA growth of 1% (10% CER) with CER EBITDA growth well aligned to CER revenue growth despite absorbing proportionately higher operating expenses in the business acquired from Sandoz in China. Organic revenue growth of 7% CER was achieved when excluding the portfolio acquired in Latin America. Gross profit margins of 58,1% (FY 2024: 59,4%) were diluted by lower Injectables gross profit margins and the relative strength of the average ZAR exchange rates against Aspen’s major trading currencies.

Prescription

Prescription Brands reported growth of 10% (16% CER), with revenue of R12 519 million. Americas led the growth, benefitting from the full year addition of the portfolio acquired in Latin America which enjoyed double digit growth on a comparable basis in H2 2025. Africa Middle East, the largest region within this segment, grew 8% with solid organic growth of 6% augmented by the Lilly franchise. Gross profit percentage of 61,8% (FY 2024: 60,9%) was supported by a favourable sales mix from Americas.

OTC

OTC revenue grew by 1% (5% CER) to R9 812 million buoyed by an expected stronger second half performance from Africa Middle East which recorded full year growth of 5% (6% CER). The Australasia OTC portfolio revenue, which grew 5% in CER, now exceeds the region’s Prescription segment and is well positioned for future growth. Gross profit percentage of 58,3% was closely aligned to the prior period (FY 2024: 58,7%).

Injectables

The Injectables portfolio returned to growth in FY 2025 rising 4% (10% CER) to R9 885 million. Africa Middle East growth of 45% was boosted by the successful launch and rollout of Mounjaro® in South Africa. The product swop transaction with Sandoz impacted Asia positively and Europe negatively. Gross profit percentage declined to 53,2% (FY 2024: 58,2%) influenced by the impact of national volume-based procurement and related one-off inventory write-offs in China.

Manufacturing

Manufacturing revenue of R11 147 million ended 21% lower (-19% CER). Reduced revenue from Heparin was the main cause of this decline as the business benefitted from high once-off sales in the prior year due to the transition to a working capital light toll model. Normalised EBITDA of R668 million in CER ended 62% lower than the prior year impacted mainly by the Dispute within the Finished Dose Form (“FDF”) segment.

PROSPECTS

Aspen is focused on optimisation strategies for its Manufacturing business and building on the gains made in Commercial Pharmaceuticals.

For FY 2026, Commercial Pharmaceuticals is expected to record mid-single digit organic revenue and stronger EBITDA growth in CER. This will be supported by a higher profit contribution from the reshaped business in China and further incremental growth from Mounjaro® in South Africa following the recent regulatory approval of the Kwikpen® delivery system indicated for type 2 diabetes management and pending approval of the chronic weight management indication. Aspen has also recently concluded a long-term distribution and promotional agreement with Boehringer Ingelheim for its product portfolio in South Africa, effective from 1 September 2025.

Considerable progress has been made in executing on Aspen’s generic semaglutide GLP-1 strategy (sterile injectable products for the treatment of type 2 diabetes and obesity). This has required extensive investment in both intellectual property (“IP”) and infrastructure. To give the Group every chance of success, Aspen has followed a strategy of both developing its own IP and licensing/partnering on IP with licensors.

It is anticipated that the first revenue from this initiative could be as early as the latter part of FY 2026. No such revenue has been included in the Commercial Pharmaceuticals guidance detailed above.

The FDF segment of the Manufacturing business is working to recover lost profitability by FY 2027. Key to achieving this objective is:

- Commercialising the insulin contract, following an intensive technical transfer process. This is an exciting opportunity for both Aspen and patients. Resultant revenue of R0,3 billion is forecast for FY 2026, ramping up to more than R1 billion for FY 2027; and

- Reshaping both Aspen’s French and South African sterile facilities to match resources with the existing contracts on hand. It is intended that most of the restructuring will be addressed in this calendar year.

The benefits of both increased revenue and cost reductions will positively impact H2 2026 and are expected to be fully realised in FY 2027.

Aspen is well positioned to execute on its strategic opportunities that will further enhance Manufacturing profitability which include, inter alia:

- Procuring regulatory approval from SAHPRA and WHO for the Serum paediatric vaccines, to be followed by commercialisation with potential sales in calendar year 2026 and increased volumes thereafter;

- On-boarding GLP-1 injectable production volumes at both the French and South African sterile facilities following the operationalisation of Aspen’s generic semaglutide strategy; and

- Securing further contracts in the South African and French sterile facilities.

The Group anticipates double digit CER growth in normalised headline earnings in FY 2026. Manufacturing normalised EBITDA was positively impacted by the contribution from the mRNA contract in H1 2025 but negatively impacted by the reversal of a portion of this contribution in H2 2025 following the onset of the Dispute. Consequently, the relative CER normalised headline earnings are expected to be lower in H1 2026 followed by stronger double-digit growth in H2 2026.

The continued focus on working capital, enhanced Manufacturing efficiencies and expected lower investment in capital expenditure (following higher GLP-1 and sterile related investments in FY 2025) should assist the Group in reducing net debt levels and achieving an operating cash conversion rate target of greater than 100% in FY 2026. The Group expects to achieve a leverage ratio of less than 3.0x at the end of FY 2026.

Any forecast information in the above-mentioned paragraphs has not been reviewed or reported on by the Group’s auditors and is the responsibility of the directors.

DECLARATION OF DIVIDEND

The Board has declared a gross dividend of 211 cents per ordinary share (2024: 359 cents per share) (or 168,8 cents net of a 20% dividend withholding tax, where this maximum rate of tax applies) which is 20% of normalised headline earnings per share and aligned to the Group’s capital allocation framework. The dividend will be paid from income reserves.

Shareholders should seek their own advice on the tax consequences associated with the dividend and are particularly encouraged to ensure their records are up to date with Aspen so that the correct withholding tax rate is applied to their dividend. The Company income tax number is 9325178714. The issued share capital of the Company is 446 252 332 ordinary shares. Future distributions will continue to be decided on a year-to-year basis. In compliance with IAS 10 – Events After the Reporting Period, the dividend will be accounted for in the financial statements in the year ended 30 June 2026.

The full announcement is available on Aspen’s website https://www.aspenpharma.com/investor-relations/#financial-results-and-presentations and can also be accessed online at https://senspdf.jse.co.za/documents/2025/jse/isse/APN/YEresults.pdf. Any investment decision must be based on the information contained in the full announcement.