-

Revenue

-

Performance

-

Prospects

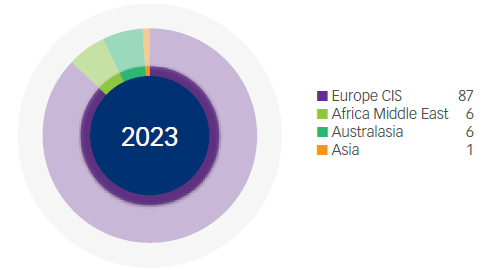

Manufacturing Revenue* (%)

*Based on source of manufacture

Notwithstanding the loss of COVID vaccine sales, in the first year following the pandemic, revenue grew 3% (CER -6%) also benefiting from exchange rate tailwinds.

The first half of the year saw a 10% decline (CER -12%) attributed to the discontinuation of COVID production, the loss of one month of production in the API segment due to strategic maintenance, as well as non-revenue-generating technical transfer activities for new products. However, the second half of the year witnessed a significant turnaround in the Manufacturing segment, with a 45% increase in reported revenues over the first half. This improvement was driven by enhanced performances in the API and Heparin segments.

The gross profit margins experienced a significant upswing, climbing from 5,2% in H1 2023 to 15,7% in H2 2023, supported by increased contributions from both the API and Heparin businesses culminating in a full-year margin of 11,4%. Nonetheless, this figure reflects a decrease of 9,1 percentage points compared to the FY2022

margin (20,6%). This decline can primarily be ascribed to the reduction in COVID vaccine contributions and, to a lesser extent, costs associated with the technical transfer of four routine vaccines, as part of the agreement with the Serum Institute of India announced in 2022. Grant funding amounting to USD30 million from the Bill and Melinda Gates Foundation and CEPI partially offset some of these costs.

We are making significant strides towards achieving our strategic goal of realising returns on the substantial investment in sterile production. This progress is evident as we advance technical transfers for capacity filling and secure new manufacturing agreements. On technical transfers, the previously announced four routine paediatric

vaccines – Pneumococcal, Rotavirus, Polyvalent Meningococcal, and Hexavalent – at our Gqeberha sterile facility has proceeded smoothly, well within the 12-to-24-month timeline set in 2022. The commercialisation of these products is dependent on future tenders and we hope to start generating revenue later in calendar year 2024.

Furthermore, our recently announced manufacturing contract with Novo Nordisk for the production of Human Insulin at our sterile facility in Gqeberha as well as the three multinational agreements for the Notre Dame de Bondeville facility, which include vaccines and mRNA technologies, are expected to contribute towards the previously communicated guidance of R2 billion and R4 billion contributions in CY2024 and CY2025, respectively. These developments underscore our commitment to harnessing the potential of sterile production and expanding our revenue streams.

Based upon current exchange rates, we expect the absolute gross margin to be flat with the prior year. This projection factors in several key considerations, including

the expected initiation of technical transfers in H1 2024, for the commercialisation of the announced opportunities. These transfers will impact production at Notre Dame de Bondeville. Additionally, our guidance accounts for the loss of grant funding that was received in the previous year to partially cover the technical transfer costs for the four routine vaccines. We expect revenue to increase in the second half of the year as some of the manufacturing agreements begin to contribute to our revenue stream. These factors collectively inform our outlook for the Manufacturing segment’s gross margin.