Johannesburg – JSE-listed Aspen Pharmacare Holdings Limited (APN), a global multinational specialty pharmaceutical company, has reported a strong performance for the year ended 30 June 2023.

SALIENT HIGHLIGHTS

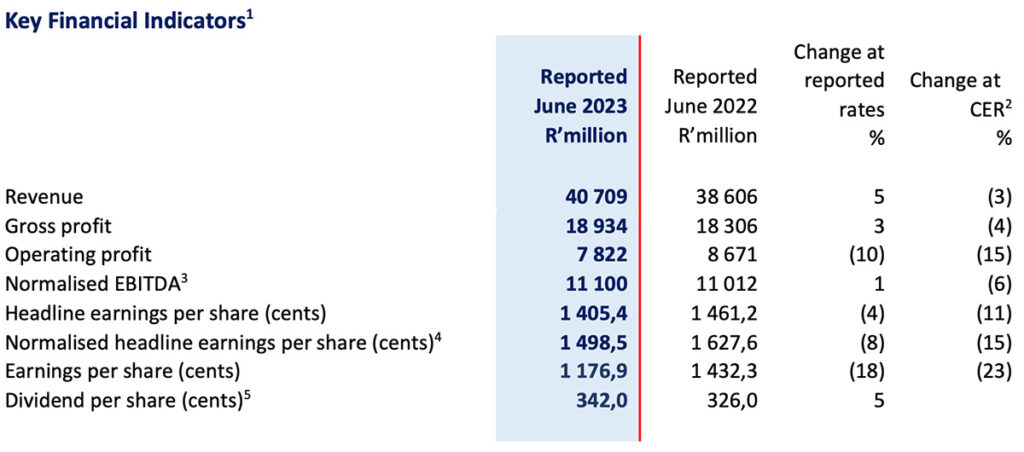

- Revenue grew by 5% (-3% in constant exchange rate (“CER”)) to R40 709 million (FY2022: R38 606)

- Normalised EBITDA rose by 1% (-6% in CER) to R11 100 million (FY2022: R11 012 million)

- Normalised headline earnings per share declined by -8% (-15% in CER) to 1 498,5 cents (FY2022: 1 627,6 cents)

- Headline earnings per share decreased by -4% (-11% in CER) to 1 405,4 cents (FY2022: 1 461,2 cents)

- Earnings per share decreased by -18% (-23% in CER) to 1 176,9 cents (FY2022: 1 432,3 cents)

- Dividend declared to shareholders increased by 5% to 342 cents per ordinary share (FY2022: 326,0 cents)

- Aspen has concluded three sterile manufacturing agreements at is French manufacturing facility and progressed a further agreement at the Gqeberha facility to an advanced technical stage subtantially progressing its medium-term strategy to fill its sterile manufacturing capacity

- An agreement was concluded with Eli Lilly and Company (“Lilly”) to distribute and promote products in Sub-Saharan Africa, subject to conditions precedent and competition authority approvals

- Aspen celebrates 25 years as a JSE-listed pharmaceutical company

Stephen Saad, Aspen Group Chief Executive said, “We are pleased to announce solid results for the year with record revenue and normalised EBITDA delivered in H2 2023. Pleasing reported revenue growth was achieved by Commercial Pharmaceuticals and Manufacturing of 6% and 3% respectively, despite the volatile global trading environment.”

“We have achieved outstanding progress in our endeavours to secure addition manufacturing volumes for our newly installed expanded sterile production capacities. We are tracking well to achieve our previous guidance of related contributions of R2 billion in calendar year 2024, increasing to R4 billion in calendar year 2025.”

“These new long-term collaborative opportunities in Manufacturing, together with the Serum agreement, concluded in 2022, will provide substantial support to our medium-term strategy to fill our sterile manufacturing capacity. This in turn presents a potential annual contribution of at least R8 billion per annum.”

“In addition, the product distribution agreement announced with Lilly ealier today, together with the recent Amgen and Viatris announcements, will provide growth momentum in our Commercial Pharmaceuticals segment. “

“We continue to actively explore additional contract manufacturing opportunities as well as further product portfolio enhancements to further drive growth into the future.”

STERILE MANUFACTURING AGREEMENTS SECURED

Aspen is pleased to announce that it has now secured three sterile manufacturing agreements with multinational pharma companies for production at its French manufacturing facility. These new long-term opportunitiestogether with the Serum agreement , concluded in 2022, will materially contribute to the foundation of Aspen’s medium-term strategy to fill its sterile manufacturing capacity. Additional agreements are under negotiation including one agreement for the Gqeberha facility already progressed to an advanced technical transfer stage.

COMMERCIAL PHARMACEUTICALS MAKES ADVANCES IN ITS PORTFOLIO ENHANCEMENT STRATEGY

Aspen has concluded an agreement with Eli Lilly Export S.A. a subsidiary of Eli Lilly and Company (“Lilly”), in terms of which Aspen will distribute and promote Lilly’s products in Sub-Saharan Africa for an initial term of 10 years, automatically renewable for two further periods of 5 years (“the Transaction”). The sales revenue of the Lilly portfolio in Sub-Saharan Africa was approximately ZAR 440 million[1] in 2022. This is expected to be materially increased by the launch of key Lilly pipeline products in the short to medium term. The pipeline includes Lilly’s Tirzepatide, marketed globally as Mounjaro®, a molecule currently under evaluation by SAPHRA and expected to be launched in South Africa in the near future. The Transaction is conditional upon the fulfilment of customary conditions precedent applicable to transactions of this nature, including competition authority approvals. It is anticipated that the Transaction will complete by the end of Q1 of calendar 2024.

The recently announced agreement for the acquisition of a portfolio of products from Viatris is an exciting and significant step forward in building on and expanding our footprint in Latin America. The annualised revenue for the product portfolio is USD92 million and includes well-known brands such as Viagra, Lipitor, Zyloft, Norvasc, Lyrica, and Celebrex. This transaction will enable Latin America to become a greater contributor to Regional Brands going forward.

These transactions, together with the recently announced transaction securing distribution rights for Amgen products in Southern Africa, will enhance the Commercial Pharmaceuticals product portfolio in emerging markets and aligns with the previous guidance of adding incremental annualised revenue upwards of USD100 million in Latin America and South Africa.

GROUP FINANCIAL RESULTS HIGHLIGHTS

1 Per IQVIA data

1 The Group assesses its operational performance using constant exchange rate (“CER”) and all segmental performance-related commentary is made with reference to the underlying CER trends. The table above compares performance to the prior comparable period at reported exchange rates and at CER.

2 The CER % change is based upon the performance for year ended 30 June 2022 recalculated using the average exchange rates for year ended ended 30 June 2023.

3 Operating profit before depreciation and amortisation adjusted for specific non-trading items as defined in the Group’s accounting policy.

4 Normalised headline earnings per share (“NHEPS”) represents headlines earnings per share (“HEPS”) adjusted for specific non-trading items as defined in the Group’s accounting policy.

5 Dividend declared on 29 August 2023, and paid 26 September 2023 (2022: Declared on 31 August 2022 and paid 26 September 2022).

GROUP PERFORMANCE

The Group achieved the guided recovery from H1 with H2 2023, delivering record revenue and normalised EBITDA. Factors which negatively impacted the first half performance relative to the prior comparative period included the Russia-Ukraine war, inflationary pressures, COVID lockdowns and volume-based procurement (“VBP”) impacts in China, the loss of COVID vaccine revenue as well as investing in non-revenue generating technical transfer activities relating to the onboarding of new sterile manufacturing opportunities.

Group revenue for the financial year ended 30 June 2023 grew 5% (-3% CER) to R40 709 million, with Commercial Pharmaceuticals revenue growing 6% (-1% CER) and Manufacturing revenue increasing by 3% (-6% CER). Gross profit grew 3% (-4% CER) ending lower than the growth in revenue with the impressive improvement in Commercial Pharmaceutical gross profit margins being more than offset by the loss of COVID vaccine contribution in Manufacturing. Normalised EBITDA rose 1% (-6% CER) to R11 100 million.

The substantial year-on-year negative swing in net financing costs of R753 million, primarily driven by foreign exchange losses of R434 million arising from weaker emerging market currencies relative to the Euro and partly due to higher interest rates, caused NHEPS to decline by -8% (-15% CER) to 1499 cents. The lower percentage reduction in HEPS of -4% (-11% CER) compared to NHEPS is attributable to reduced transaction costs in the current financial year. The higher percentage decline in earnings per share of -18% (-23% CER), relative to HEPS is due to the prior year benefit of a profit on sale of a product portfolio divested in South Africa.

Despite the Group having to increase heparin inventory levels to support the conclusion of an extended heparin supply agreement with Viatris (which forms part of the recently announced transaction in Latin America) it managed to achieve a healthy H2 2023 cash conversion rate of 115% (H1 2023: 58%), ending the full year at 88% and growing operating cash flow per share by 5%.

SEGMENTAL PERFORMANCE

Commercial Pharmaceuticals

Commercial Pharmaceuticals revenue, comprising Regional Brands and Sterile Focus Brands, grew by 6% (CER -1%) to R29 412 million aided by a resilient second half growth of 11% (CER +1%) compared to H2 2022. This growth was achieved even after the divestment of products in South Africa as well as the challenges documented earlier. Improved gross profit margins resulted in a gross profit growth of 10% (CER +2%) to R17 647 million, well exceeding revenue growth.

Regional Brands

The Regional Brands segment, which comprises 46% of Group revenue, increased by 8% (CER +1%) to R18 824 million. Excluding the impact of the prior year product portfolio divestment in South Africa (R381 million), revenue grew 11% (CER +3%) with Australasia being the key contributor recording growth of 15% (CER +7%) underpinned by the performance of its growing OTC segment. Regional Brands have shown resilience, stability, and sustained growth in a volatile global trading environment.

Gross profit percentage was well up at 59.6% (FY2022: 56.5%), augmented by cost of goods savings and a favourable sales mix which more than offset inflationary pressures.

Sterile Focus Brands

Full year revenue grew by 3% (CER -6%) to R10 588 million. Sterile Focus Brands enjoyed a strong revenue rebound in the second half, recording growth of 14% (CER +2%) against H2 2022 compared to a decline in first half revenue of -6% (CER -13%) due to the afore-mentioned challenges in both Russia and China.

Gross profit percentage of 60.6% was closely aligned with the previous financial year (FY 2022: 60.7%) despite inflationary and logistical pressures, external supplier challenges and the negative impact of VBP in China. Continued cost of goods savings from insourcing production and a favourable sales mix have been key contributors.

Manufacturing

Notwithstanding the loss of COVID vaccine sales, revenue grew by 3% (CER -6%) also benefiting from exchange rate tailwinds. Manufacturing revenue in the second half of the financial year increased by 45% compared to the first half and ended flat in CER versus H2 2022 bolstered by the guided strong H2 performances from both the API and Heparin businesses.

Second half gross profit percentage of 15.7% (H1 2023: 5.2%) supported by increased contributions from both the API and Heparin businesses ensured a double-digit full year gross profit percentage of 11.4%. The receipt of grant funding from the Bill and Melinda Gates Foundation and Coalition for Epidemic Preparedness Innovations helped to partially offset sterile production costs related to the introduction of the Serum Institute of India vaccines.

PROSPECTS

The Group has achieved a solid set of results for the year ended 30 June 2023, well aligned to the guidance provided at the interim results announced in March 2023.

The Group has strong short to medium term prospects for both Commercial Pharmaceuticals and Manufacturing. Based upon current exchange rates, we anticipate Commercial Pharmaceuticals to achieve double-digit reported revenue growth in FY 2024 with a heavier H2 weighting driven by organic growth and the recently announced product portfolio additions in Latin America and South Africa. This targeted growth takes into account further VBP risk expected in China in FY 2024. To mitigate this VBP risk, potential acquisitive opportunities are being actively explored to diversify and de-risk the product portfolio in that country on a sustainable long-term basis.

Substantial progress has been achieved in the medium-term strategy to fill existing sterile manufacturing capacity which has a potential annual total contribution of at least R8 billion. We are focused on securing additional contracts to further enhance utilisation and related contributions. The short-term focus is on successfully executing on the existing agreements to achieve the guided contributions of R2 billion in calendar year 2024, increasing to R4 billion in calendar year 2025. Non-revenue generating technical transfer activities for the onboarding of the sterile manufacturing opportunities, including mRNA filling capabilities, planned for H1.

Anticipated FY 2024 reported results will receive an uplift should the currently weaker ZAR continue in the year ahead. Based upon current exchange rates, reported normalised EBITDA is expected to grow over the prior year. H1 reported normalised EBITDA is anticipated to be in line with the prior year comparative period impacted by the potential downside of VBP in China and the loss of grant funding of USD 20 million which benefited the prior year H1. H2 reported normalised EBITDA is expected to benefit from the new Commercial Pharmaceuticals portfolio additions, potential transaction related offsets to VBP in China and increased Manufacturing contract revenue flowing from the secured agreements. Finance charges will continue to be influenced by the interest rate cycle. Lower targeted Manufacturing inventory levels are expected to reduce working capital cash flow investment compared to FY 2023 and an operating cash conversion rate of greater than 100% is expected.

H2 2024 should represent a significant inflection point for the Group and should form the foundation for sustainable strong future earnings growth. Over the medium term the Group is anticipating accelerated growth. This will be underpinned by the annualised income streams covered above, flowing from new opportunities realised during H2 2024.

Any forecast information in the above-mentioned paragraphs has not been reviewed or reported on by the Group’s auditors and is the responsibility of the directors.