Johannesburg – JSE-listed Aspen Pharmacare Holdings Limited (APN), a global multinational specialty pharmaceutical company, has reported solid unaudited interim Group financial results for the six months ended 31 December 2023.

SALIENT HIGHLIGHTS

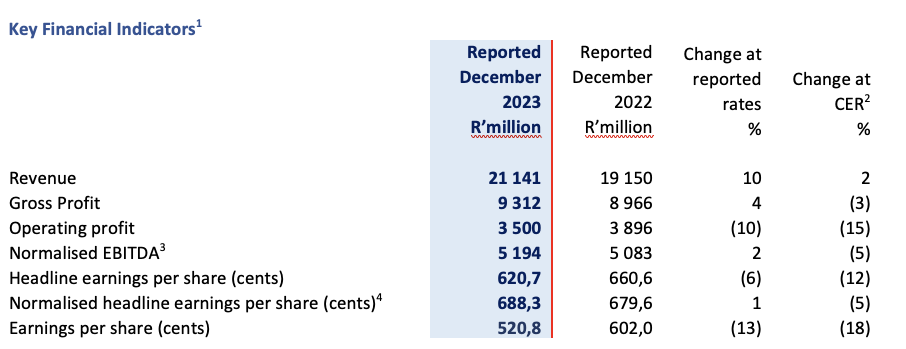

- Revenue increased by 10% (2% in constant exchange rate (“CER”)) to R21,1 billion (December 2022: R19,2 billion)

- Normalised EBITDA increased by 2% (-5% in CER) to R5,2 billion (December 2022: R5,1 billion)

- Normalised headline earnings per share increased by 1% (-5% in CER) to 688,3 cents (December 2022: 679,6 cents)

- Headline earnings per share decreased by 6% (-12% in CER) to 620,7 cents (December 2022: 660,6 cents)

- Earnings per share decreased by 13% (-18% in CER) to 520,8 cents (December 2022: 602,0 cents)

- Operating cash flow per share increased by 44% to 553,2 cents (December 2022: 384,3 cents)

1The Group assesses its operational performance using constant exchange rate (“CER”). The table above compares performance to the prior comparable period at reported exchange rates and at CER.

2 The CER % change is based upon the performance for the six months ended 31 December 2022 recalculated using the average exchange rates for six months ended 31 December 2023.

3Operating profit before depreciation and amortisation adjusted for specific non-trading items as defined in the Group’s accounting policy.

4 Normalised headline earnings per share (“NHEPS”) represents headlines earnings per share (“HEPS”) adjusted for specific non-trading items as defined in the Group’s accounting policy.

GROUP PERFORMANCE

The Group has exceeded its guided performance growing normalised EBITDA ahead of H1 2023 and overcoming the negative impact of VBP in China as well as the loss of grant funding which benefitted the prior period.

Group revenue for the six months ended 31 December 2023 grew 10% (2% CER) to R21 141 million, with Commercial Pharmaceuticals revenue up 3% (-3% CER) and Manufacturing revenue increasing by 33% (17% CER). Group gross profit grew 4% (-3% CER) muted by an increased Manufacturing sales mix. Normalised EBITDA rose 2% (-5% CER) to R5 194 million. Elevated transaction costs primarily relating to acquisitions, together with increased intangible asset impairments due to the VBP impact in China, resulted in operating profit declining.

Normalised net financing costs of R566 million were 3% (-10% CER) lower than the prior year. Increased net interest costs, fueled by higher rates, were more than offset by lower foreign exchange losses resulting from reduced volatility in emerging market currencies relative to the Euro. NHEPS advanced 1% (-5% CER) aided by the lower net financing costs. Financing costs in H2 2024 will continue to be influenced by the interest rate cycle and emerging market foreign currency volatility. HEPS declined by 6% (-12% CER) and earnings per share ended 13% lower (-18% CER) affected by the higher transaction costs and intangible asset impairments respectively.

SEGMENTAL PERFORMANCE

Commercial Pharmaceuticals

Aspen has revised and refined its reportable segments to align to the Group’s Commercial Pharmaceuticals growth strategy. The new segments comprise Prescription, Over-the-counter (“OTC”) and Injectables which have been defined in the basis of accounting section of the financial results.

Commercial Pharmaceuticals revenue grew by 3% (CER -3%) to R 15 029 million underpinned by organic growth in OTC and Prescription offset by a decline in Injectables revenue. Gross profit margins remained consistent at 59.8% (H1 2023: 60.0%).

Prescription

Prescription Brands recorded revenue of R5 306 million enjoying steady momentum of 7% (CER 1%) aided by growth in its largest region, Africa Middle East, and the Americas. Australasia, the second largest region in this segment, was adversely impacted by further regulated price reductions.

Gross profit percentage was up at 61.6% (H1 2023: 60.7%) augmented by a favourable sales mix, which more than offset the regulated price cuts in Australia.

OTC

OTC, the second largest segment in Commercial Pharmaceuticals, grew revenue by 10% (CER 4%) to R4 893 million with all regions reporting solid growth. Gross profit percentage of 58.8% remained in line with the prior year of 58.6%.

Injectables

This segment was heavily impacted by further VBP in China and the reduction in demand in Russia CIS. Strong hormonal injectable brand growth in the Americas (most notably Brazil) partly mitigated the overall segment sales reduction which recorded a revenue decline of 6% (CER -12%) to R4 830 million.

Gross profit percentage declined to 58.9% (H1: 2023 60.5%) influenced by the impact of VBP, partly offset by further cost of goods savings from insourcing sterile production.

Manufacturing

Manufacturing revenue grew significantly, increasing 33% (CER 17%) partly aided by exchange rate tailwinds. API, the largest and most profitable segment in Manufacturing, rebounded strongly in H1 2024 with revenue growing by 18% (CER 4%). Finished Dose Form (“FDF”) revenue increased by 10% (CER -2%) impacted by the loss of final COVID vaccine sales included in the previous year. Heparin incremental revenue growth of R957 million over the comparable period was augmented by the transition to toll manufacture. Following this transition the Heparin segment which previously included the full value chain contribution from all heparin containing products being APIs and FDF sales, will now include heparin API sales only.

Gross profit percentage was in line with the prior year at 5.3% (H1 2023: 5.2%) with the loss of grant funding being offset by a strong performance from API, the benefit of additional Heparin sales and the delay to the second half of FY2024 of a technical shutdown at the Group’s French facility.

PROSPECTS

The Group has achieved results in the first half which were well aligned to guidance provided.

H2 2024 is the start of the journey to both realising the tangible benefits from sterile manufacturing investments and delivering a predictable growing base Commercial Pharmaceuticals business that has managed and successfully absorbed the VBP risks faced in China.

Based upon current exchange rates, and notwithstanding the impact of VBP in China and the loss of grant funding of USD30 million which benefitted the prior year, we anticipate mid-single digit reported growth in normalised EBITDA for FY2024. The targeted growth is underpinned by expected reported revenue growth in both Commercial Pharmaceuticals and Manufacturing.

For Commercial Pharmaceuticals, we expect the H1 2024 revenue increase to be boosted by an additional R1 billion in revenue growth targeted for H2 2024 over H2 2023. This growth will be driven organically and complemented by the inclusion of portfolio acquisitions in South Africa and Latin America partly offset by the impact of VBP in China, including the addition of Diprivan in the latest round. Manufacturing is poised to enjoy a strong second half supported by the expected contribution of R500 million flowing from the initiation of sterile contracts and a seasonally stronger performance from the API business.

We expect manufacturing inventory levels to reduce in H2 2024 as the Heparin business fully transitions to a working capital light toll manufacturing model. The lower anticipated working capital cash flow investment compared to FY2023 should assist us in achieving an operating cash conversion rate greater than our target of 100%.

During H2 2024, we will be looking to close out further opportunities, currently under discussion or diligence, to more fully utilise our available sterile capacities. We remain confident in achieving the guided contributions of at least R3 billion in FY2025 increasing to no less than R4 billion in FY2026. These contributions, together with a de-risked Commercial Pharmaceuticals’ base business will form the cornerstone for strong organic revenue and earnings growth into the future.

Any forecast information in the above-mentioned paragraphs has not been reviewed or reported on by the Group’s auditors and is the responsibility of the directors.