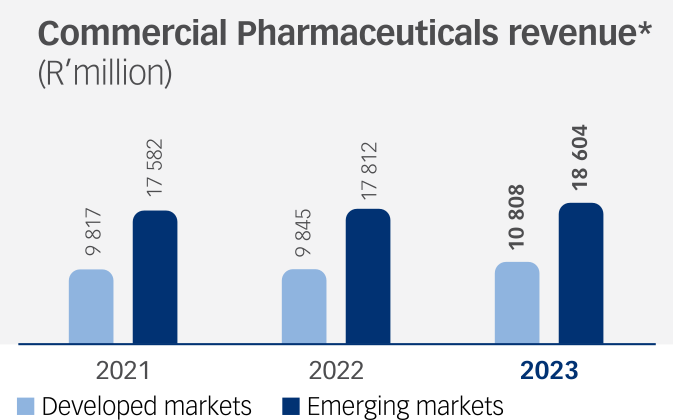

- Commercial Pharmaceuticals

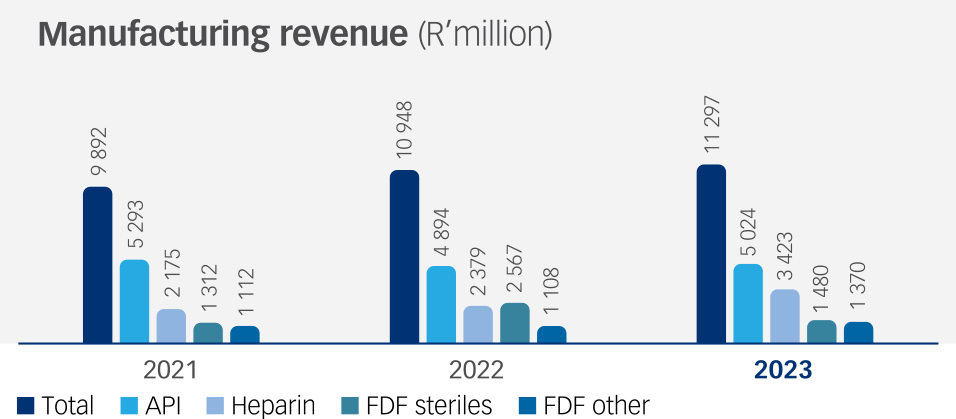

- Manufacturing

Delivering quality affordable medicines while enhancing stakeholder value responsibly

Committed management team aligned with shareholder interest

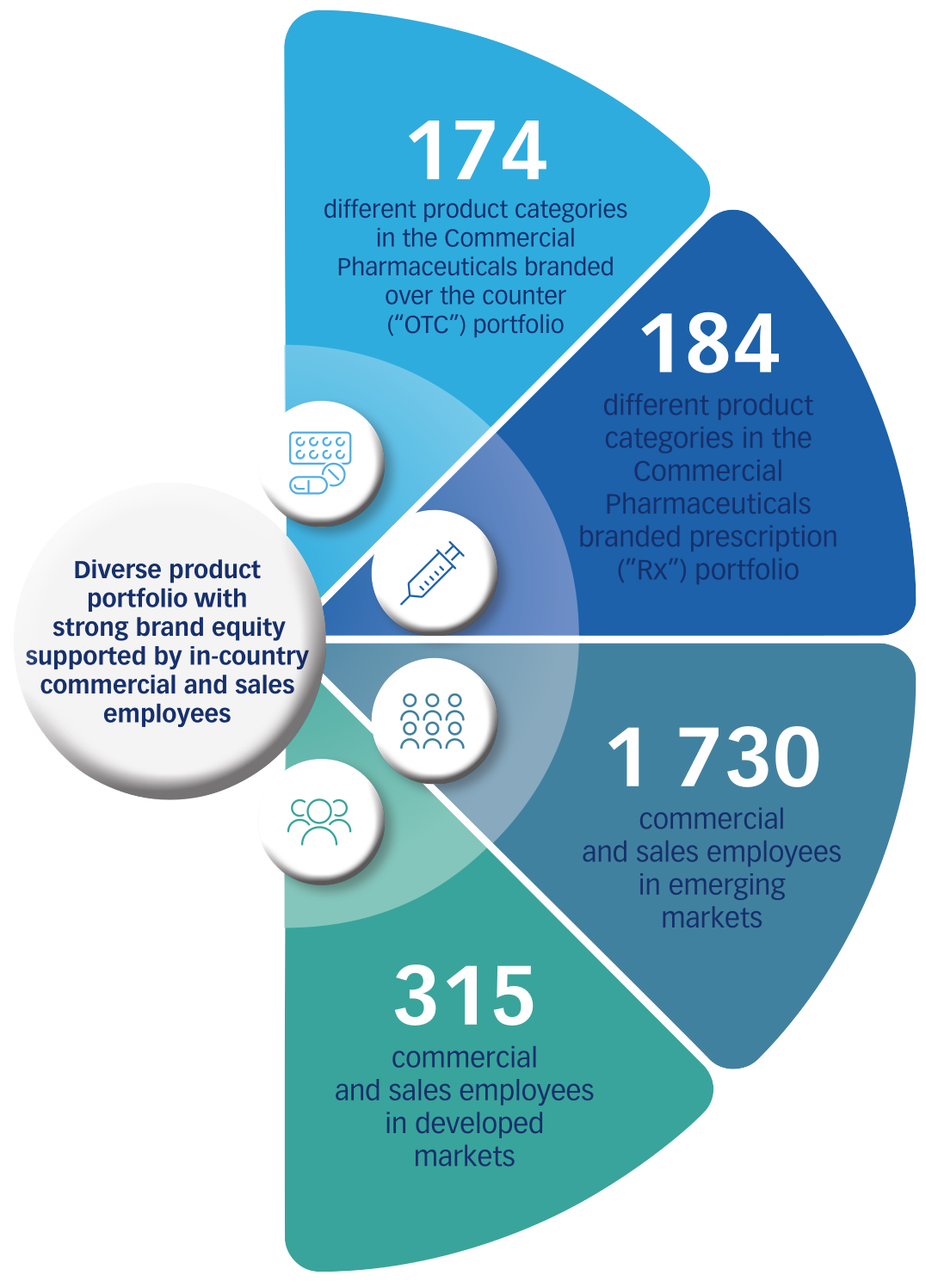

Decentralised in-country structures enable local teams to operate with entrepreneurial flair, creating value by applying local experience

12,9% Shareholding by executive management

A purpose-driven strategy with the promotion of access to medicine at its core

Manufactured 225 million doses of COVID vaccines and signed a 10-year agreement with the Serum Institute of India Pvt Ltd (”Serum Institute”) promoting access to vaccines in Africa

Supplied 180 medicines appearing on the Essential Medicines List to 60 low- to middle‑income countries

Consistent inclusion in the FTSE/JSE Responsible Investment Index since 2016 and member of the FTSE4GoodIndex

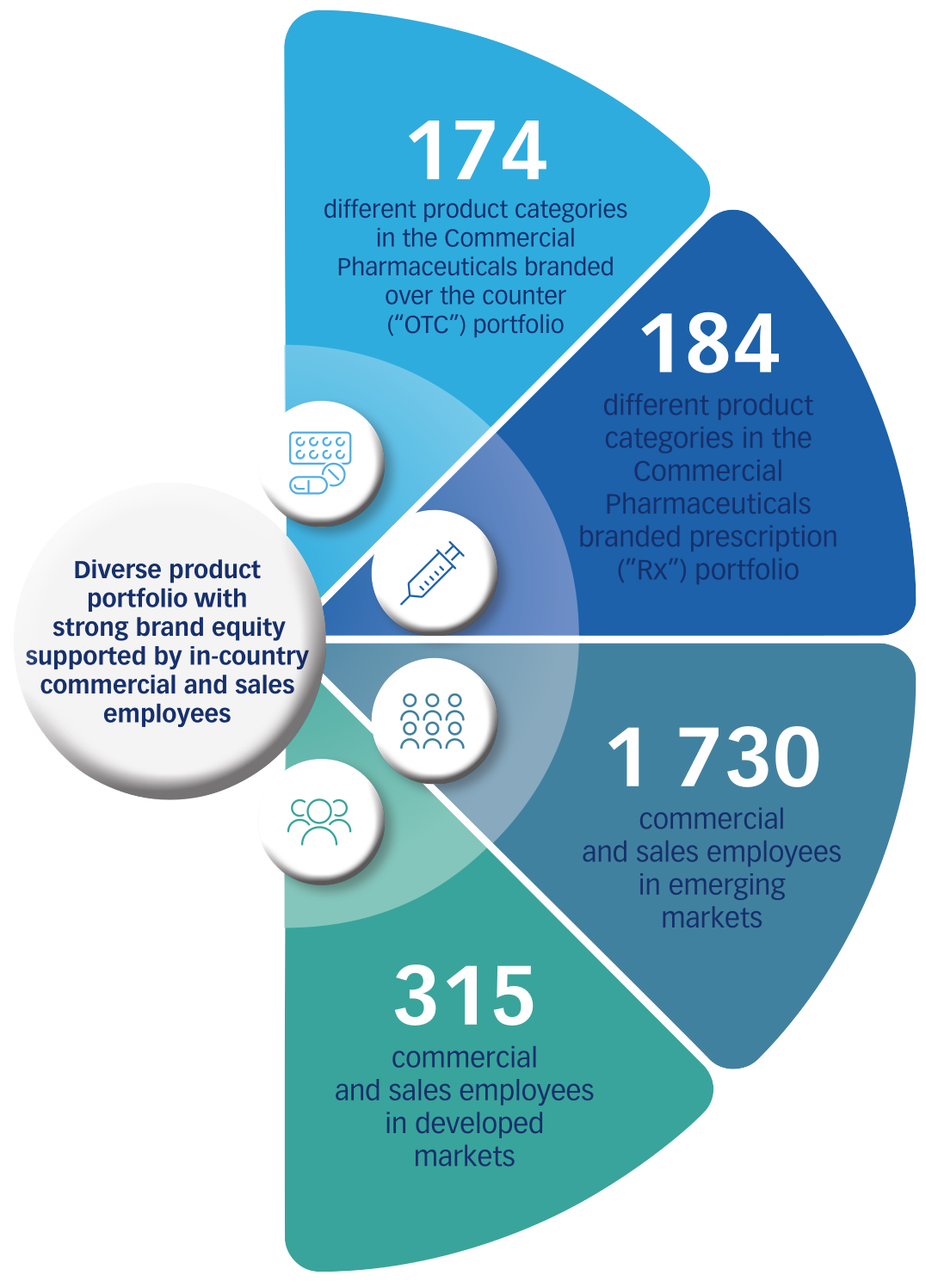

Commercial Pharmaceuticals: branded post-patent global and domestic products

Commercial Pharmaceuticals portfolio supported by a global footprint weighted to emerging markets with emerging market fundamentals

* Commercial Pharmaceuticals revenues in 2022 and 2021

excludes revenues from products divested in SA in 2022.

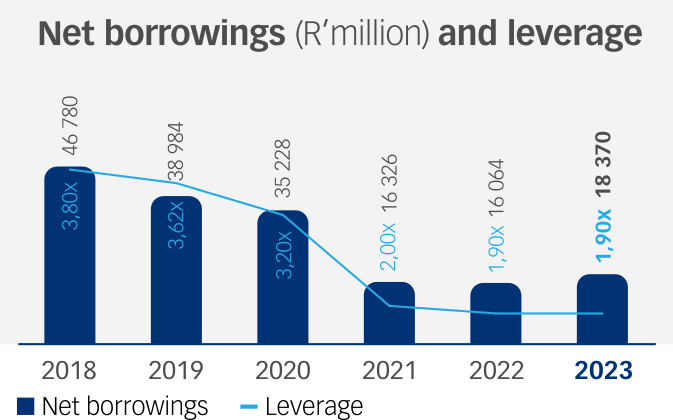

Headroom to invest in the Commercial Pharmaceuticals portfolio, inherent to portfolio growth strategy

Delivering quality affordable medicines while enhancing stakeholder value responsibly

Manufacturing: Capacities for own and third-party use

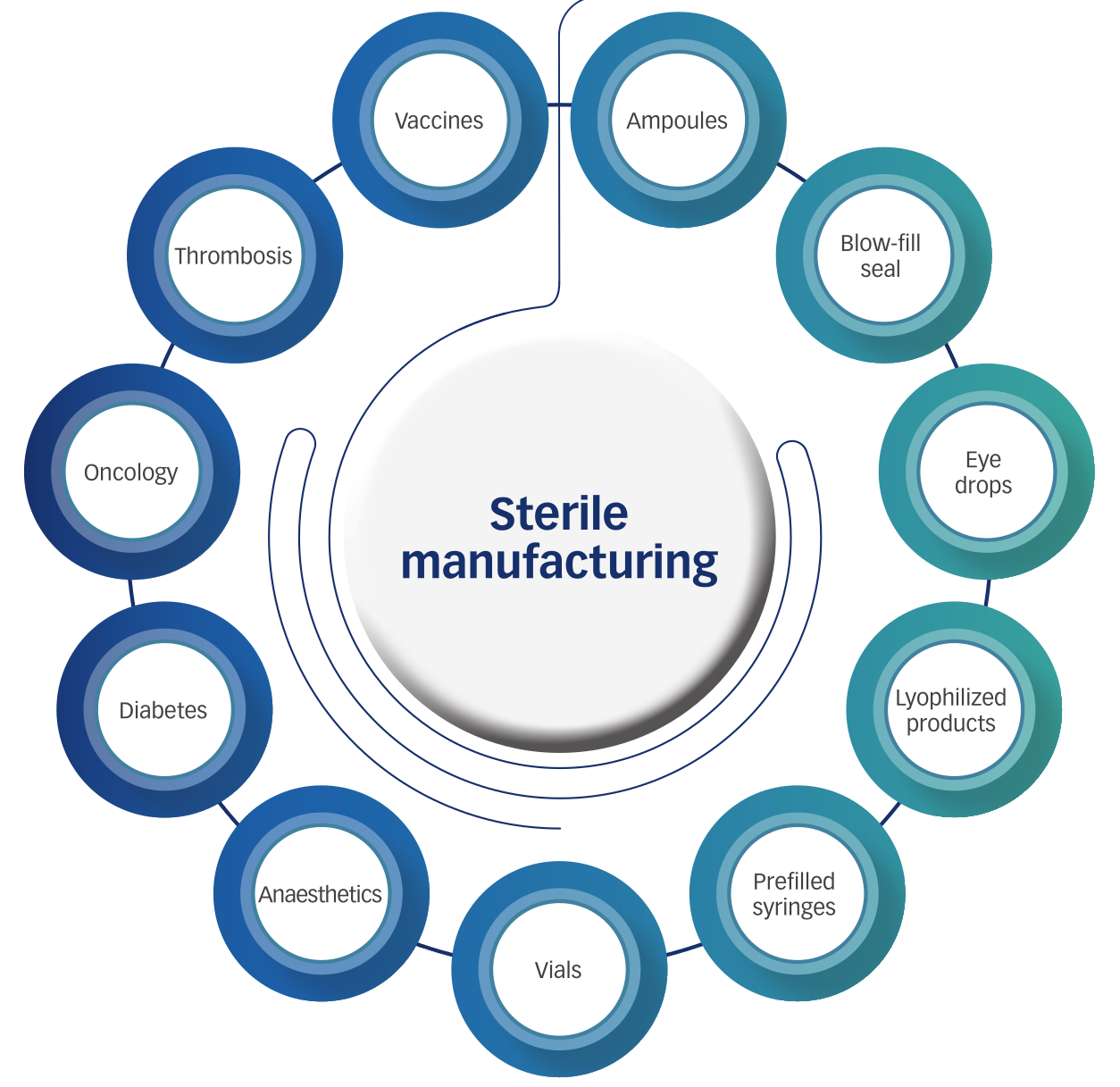

Widely accredited and compliant API and FDF manufacturing capabilities with increasing focus on complex sterile capacities

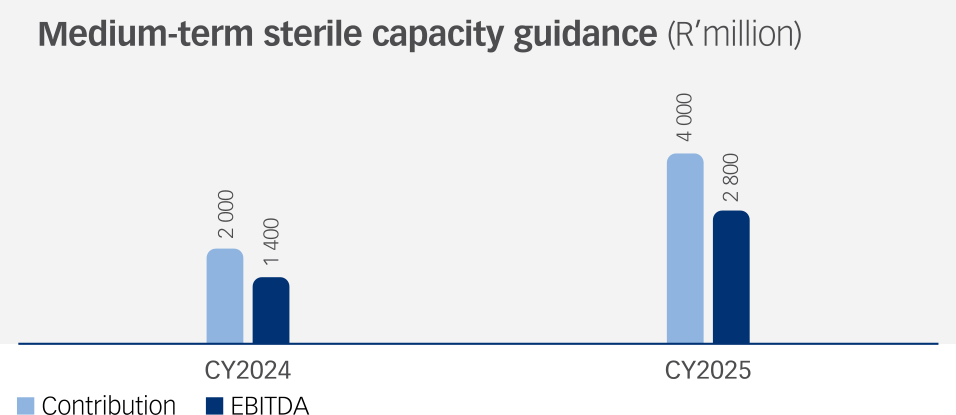

Increasing returns as sterile manufacturing capacities come online

Strategically relevant manufacturing capacities to deliver accelerated growth

Capabilities/dosage forms:

- Ampoules

- Blow-fill seal

- Eye drops

- Lyophilized products

- Prefilled syringes

- Vials

Therapies:

- Ampoules

- Blow-fill seal

- Eye drops

- Lyophilized products

- Prefilled syringes

- Vials