-

Revenue

-

Performance

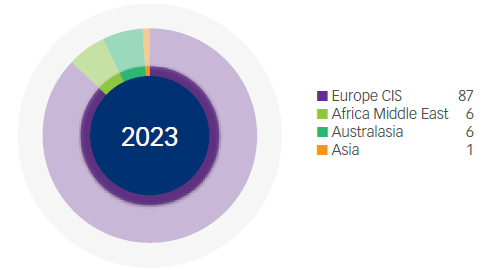

Manufacturing Revenue* (%)

*Based on source of manufacture

Notwithstanding the loss of COVID vaccine sales, in the first year following the pandemic, revenue grew 3% (CER -6%) also benefiting from exchange rate tailwinds.

The first half of the year saw a 10% decline (CER -12%) attributed to the discontinuation of COVID production, the loss of one month of production in the API segment due to strategic maintenance, as well as non-revenue-generating technical transfer activities for new products. However, the second half of the year witnessed a significant turnaround in the Manufacturing segment, with a 45% increase in reported revenues over the first half. This improvement was driven by enhanced performances in the API and Heparin segments.

The gross profit margins experienced a significant upswing, climbing from 5,2% in H1 2023 to 15,7% in H2 2023, supported by increased contributions from both the API and Heparin businesses culminating in a full-year margin of 11,4%. Nonetheless, this figure reflects a decrease of 9,1 percentage points compared to the FY2022

margin (20,6%). This decline can primarily be ascribed to the reduction in COVID vaccine contributions and, to a lesser extent, costs associated with the technical transfer of four routine vaccines, as part of the agreement with the Serum Institute of India announced in 2022. Grant funding amounting to USD30 million from the Bill and Melinda Gates Foundation and CEPI partially offset some of these costs.